Shopify tax calculation

Eliminate the burdens of gathering tax data with the help of. A key feature of Shopify Markets available to Shopify Advanced and Plus merchants is a native Duties Import Taxes calculator which lets merchants calculate and.

How To Use An Excel Spreadsheet Excel Spreadsheets Excel Spreadsheets Templates Spreadsheet Template

These charges are billed by the external provider and wont appear on your Shopify invoice.

. Shopify tax calculation Sabtu 03 September 2022 Edit. Maximize your potential and grow your business with unlimited capital aligned to your plan. In-state sales of cosmetics to customers are taxable under current state and local tax rates assuming a business is located in a state that has a sales.

Initial setup fee starts at 1000. Ideally Id like to enter line-items and customer. Lets plan your success.

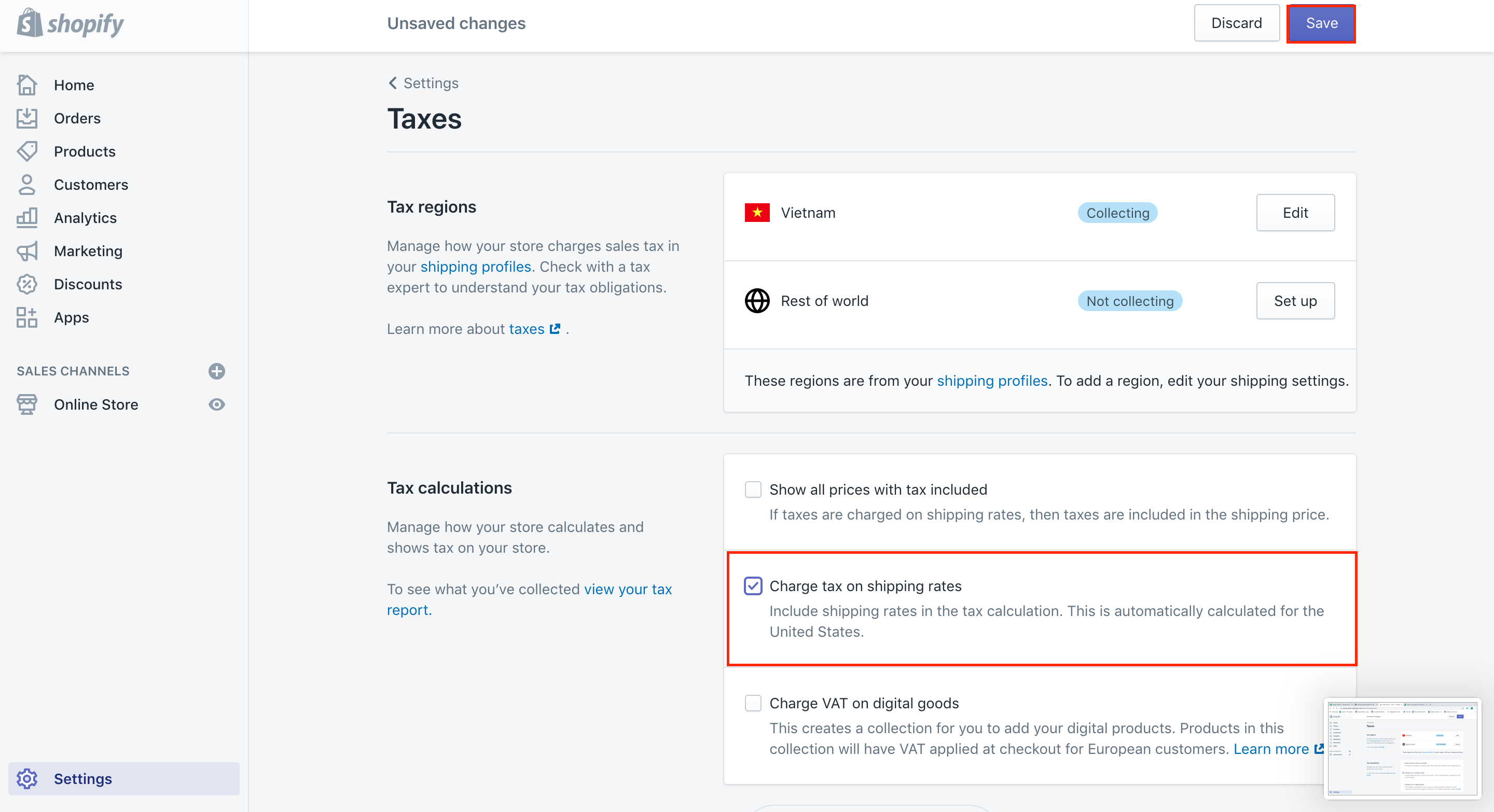

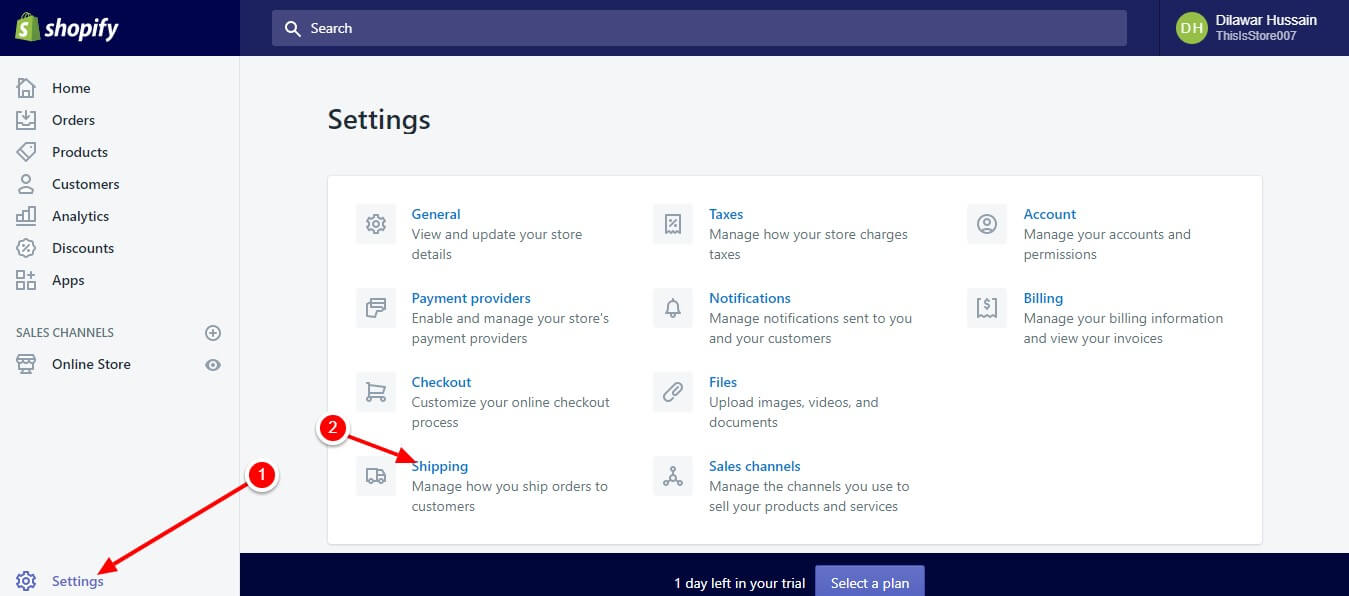

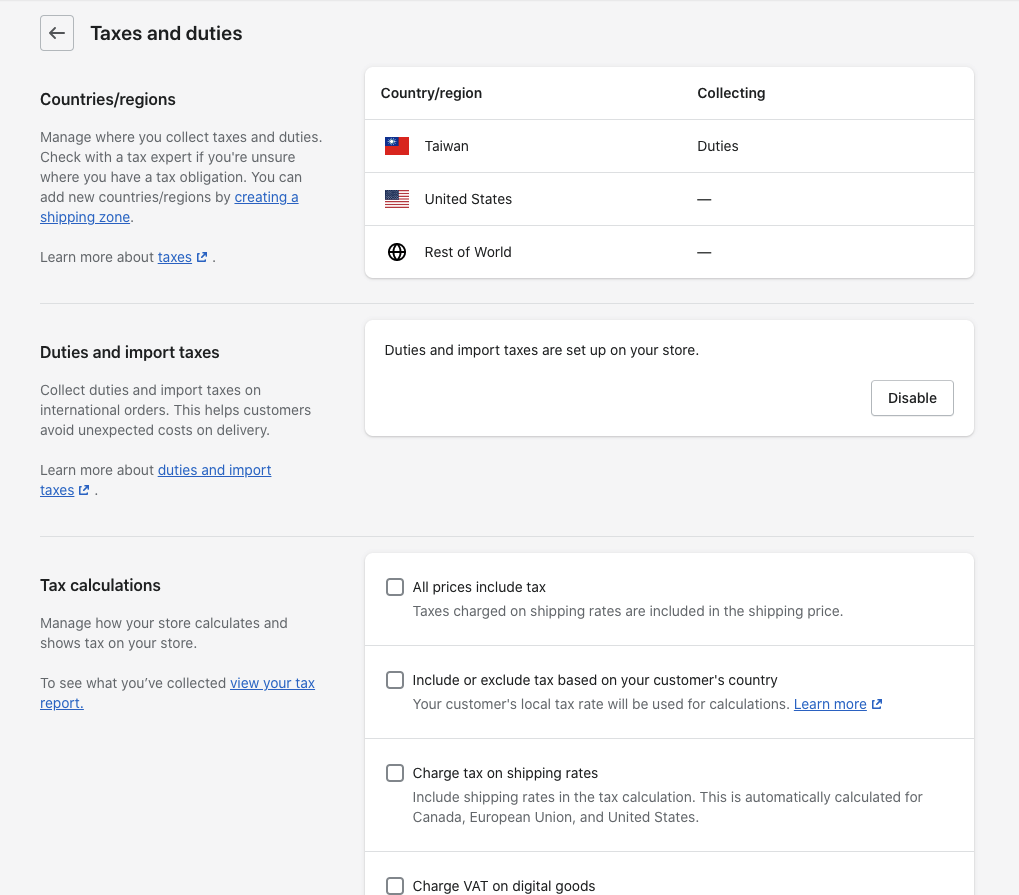

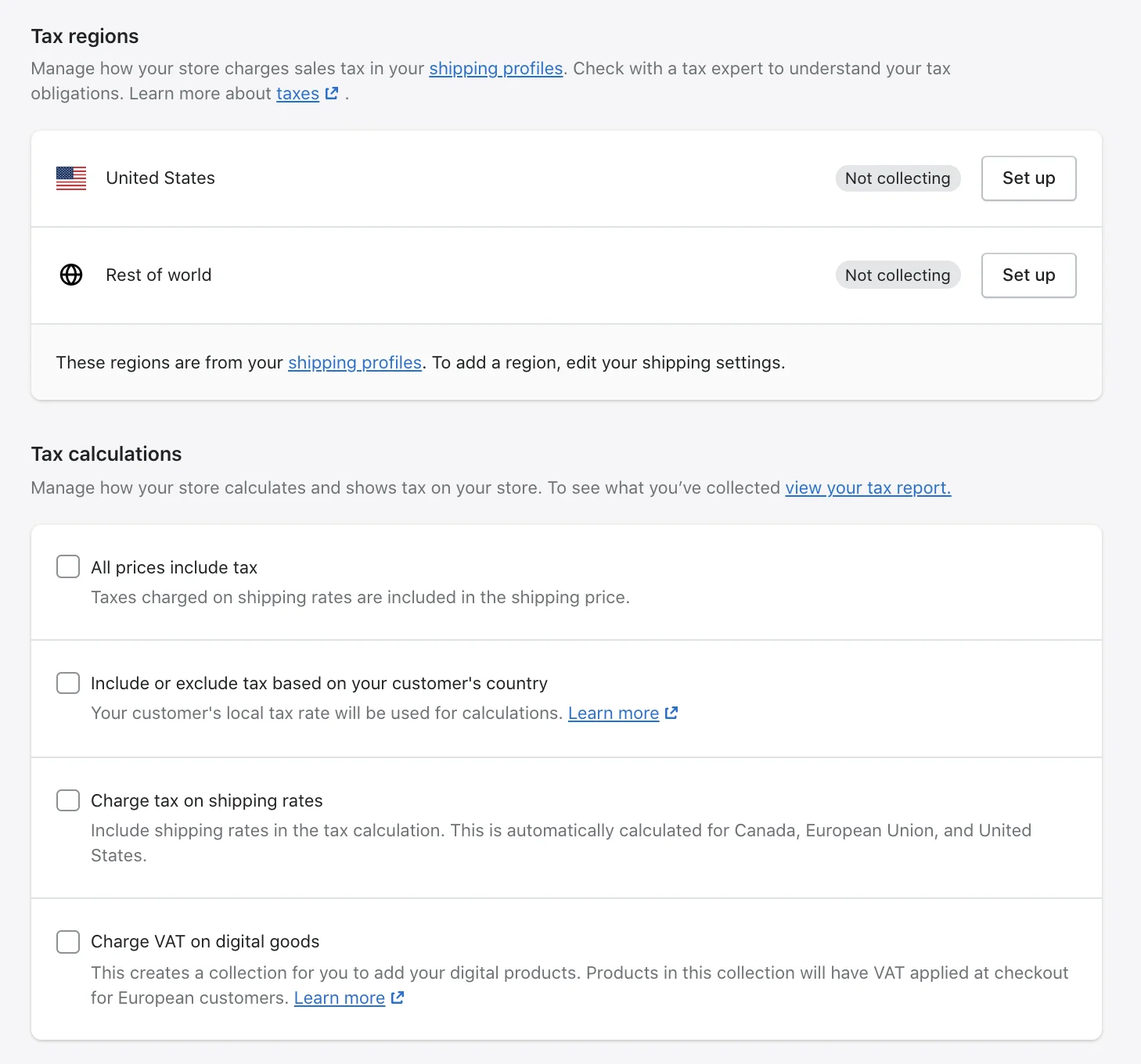

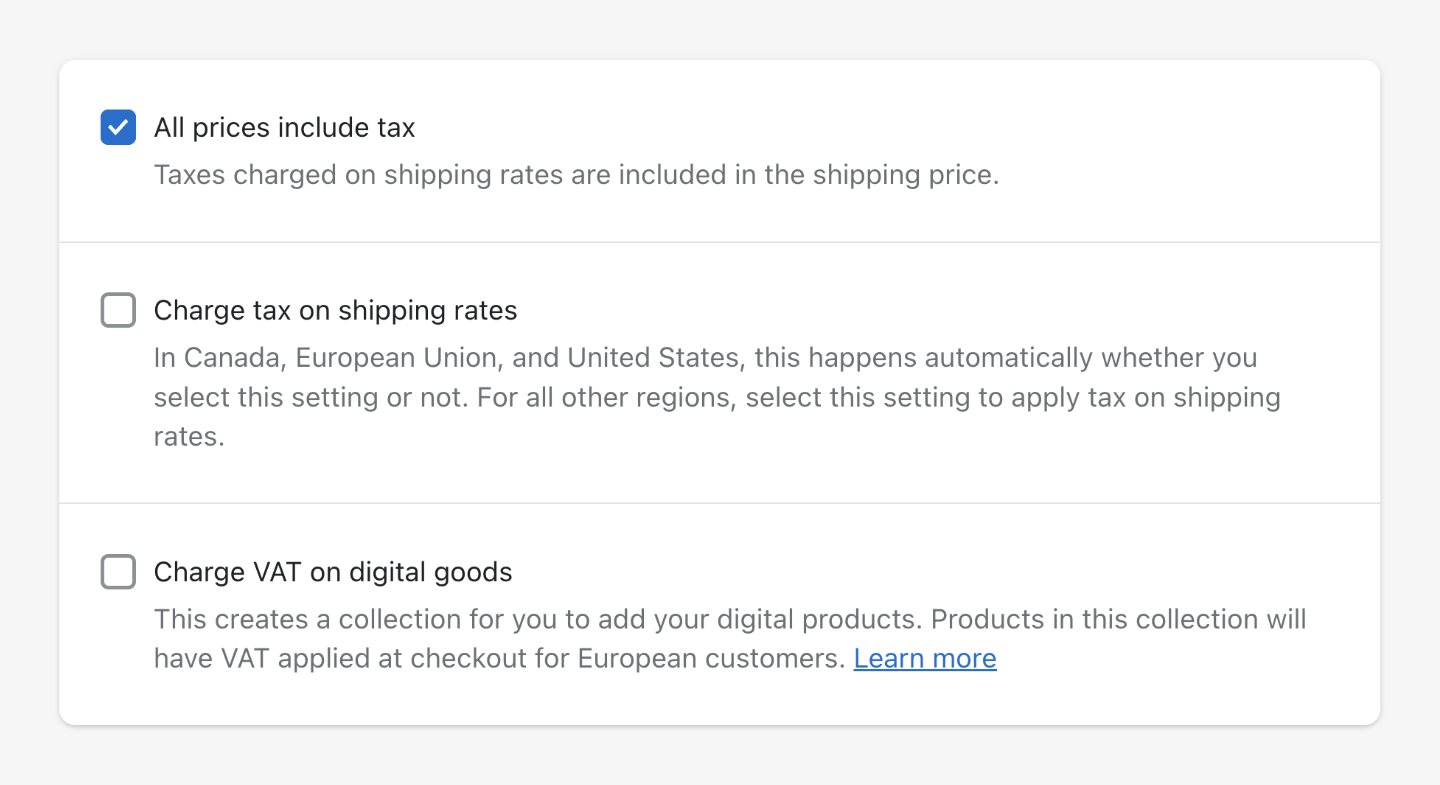

Set up your taxes in Shopify After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to. 1 Is it correct that there is no way to use the Shopify API to calculate sales tax. Ad Keep more profit while reducing risk and stress.

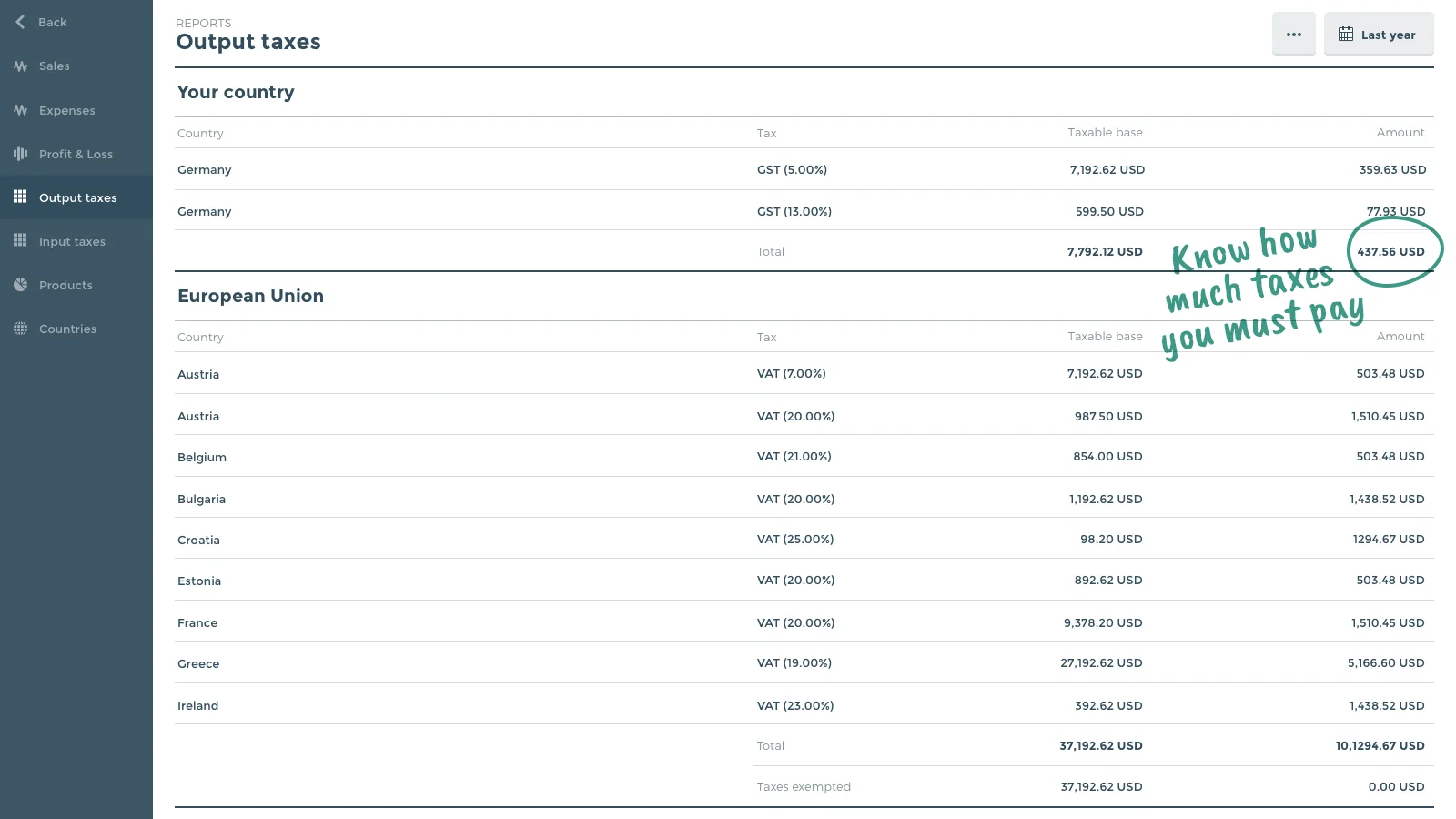

Ad Keep more profit while reducing risk and stress. Shopify comes out-of-the-box with tax rates for different regions. For this we would like to calculate taxes.

Shopify recently updated their default sales tax collection for California as of April 2020. Prior to April 2020 Shopifys automatic tax collection service defaulted to calculating tax rates in. 20month 19 transaction fee for international orders.

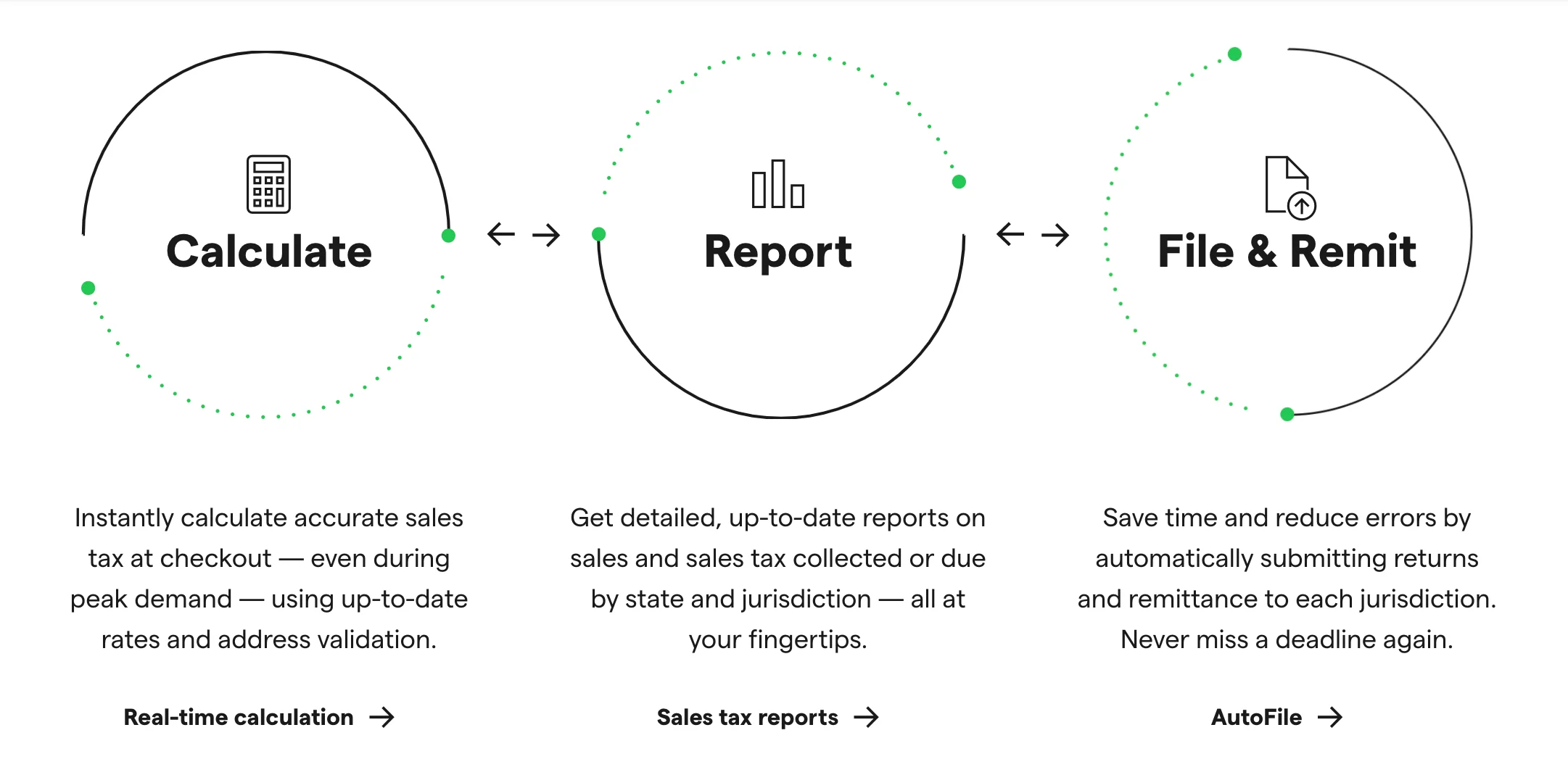

Maximize your potential and grow your business with unlimited capital aligned to your plan. Our innovative cloud-based sales tax calculation program AvaTax determines and calculates the latest rates based on location item legislative changes. These will depend on the shipping zones you set up for your store and on the location of your business.

Ideally Id like to enter line-items and customer address. Lets plan your success. The Sales Tax charged should.

Separate Sales Tax Include your sales tax separately from the price of the item. Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US. A customer in Rohnert Park CA Sonoma county was taxed 725 for state and 0875 for county but not the 050 Rohnert Park City tax.

Here are a few key recommendations when it comes to setting up sales tax in Shopify.

How To Charge Taxes On Shopify Store

How To Charge Shopify Sales Tax On Your Store Sep 2022

How To Charge Shopify Sales Tax On Your Store Sep 2022

Shopify Apps For Taxes Simple Guide To Taxes On Shopify

Rule Of 69 Meaning Benefits Limitations And More Financial Life Hacks Learn Accounting Accounting Basics

1

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

Rich And User Friendly Features Of Opencart Ecommerce Website Development Opencart Ecommerce

Shopify Calculating California Sales Tax Incorrectly Shopify Community

How To Price Your Products In 3 Simple Steps 2022

How To Charge Shopify Sales Tax On Your Store Sep 2022

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Shopify Duties And Taxes Support Shopify Markets Easyship Support

How To Charge Shopify Sales Tax On Your Store Sep 2022

Include Or Exclude Tax From Product Prices In Shopify Sufio For Shopify

Pin On Shopify