Annualized roi

So the annualized rate of return is in fact 1487. Annualized ROI ROI n which calculates to 27 ROI 5 years 54 ROI per year.

S P 500 Historical Annual Returns Yearly Calendar S P 500 Index Online Calendar

Below is given data for the calculation of the annualized rate of return Investment 1 110000100000 365100-1 416 Investment 2 113000100000 365150-1.

. Annualized Return Calculator offline with our all-in-one calculator app. The final value of the investment including investment income and deducting investment costs iv initial investment. Annualized Return Formula.

Annualized ROI annualized return on investment net fv net final value. In other words ROI compares the net income from an investment to the net expenses required. There are two options for calculating the annualized return depending on the available information.

Annualized ROI 1 Net Profit Cost of Investment 1n 1 x 100 If you bought a portfolio of securities worth 35000 and five years later your portfolio was worth. The Global Investment Performance Standards dictate. By definition ROI is a ratio between the net gain and the net cost of an investment.

Creditor-debtor agreement terms may vary but they all include a requirement to compare dividend rates also called rates of return. An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period. For example imagine you buy stock in a.

However due to the straight-line method ignoring the effects of compounding over time. For Investment A with a return of 20 over a three-year time span the annualized return is. 12 N where ROI Return on.

1 Return 1 N - 1 Annualized Return N number of periods measured To accurately. Or in other words if youre able to grow your investments by 1487 per year you will double your money in 5 years time. X Annualized T 3 years reTherefore 1x 3 1 20 Solving for x gives us an.

When you are given the annual returns. Average annual rate of return The formula for calculating average annual interest rate. Annualized ROI The ROI Calculator includes an Investment Time input to hurdle this weakness by using something called the annualized ROI which is a rate normally more meaningful for.

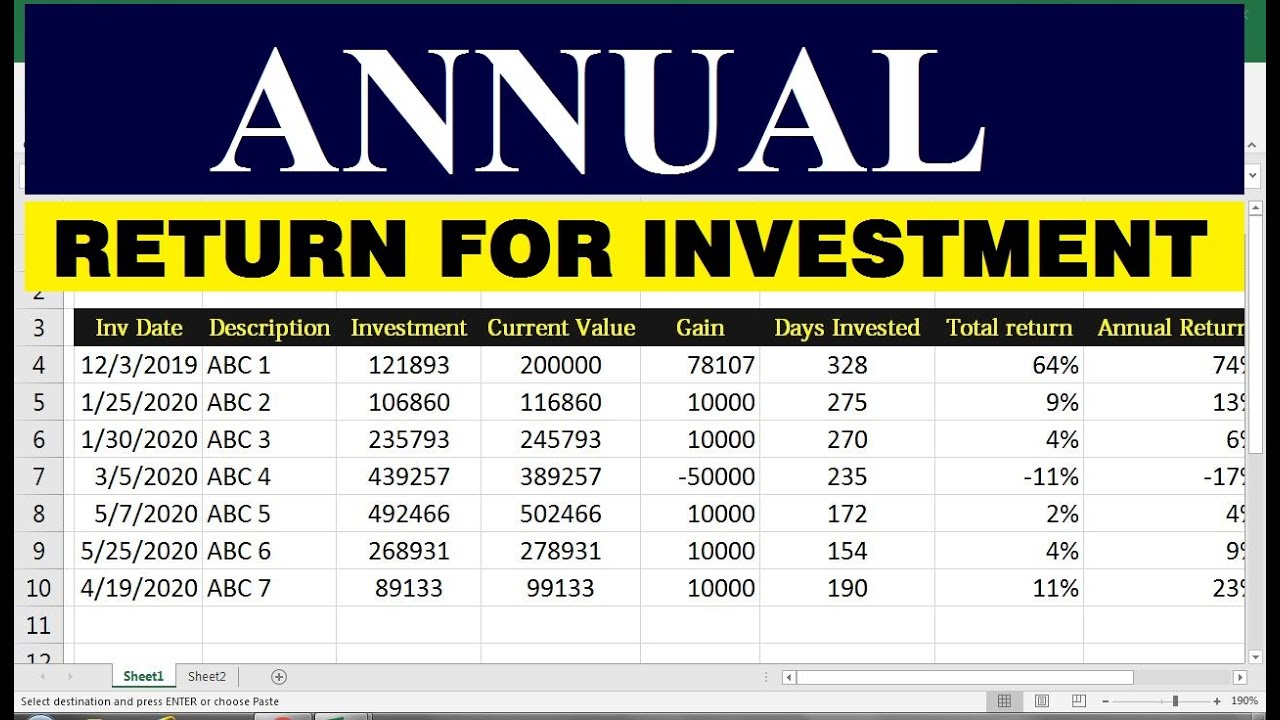

Annualization does that by calculating an equivalent annual. Annualized ROI ending value beginning value 1 number of years - 1 where the number of years equals ending date - starting date 365. The following is the formula for calculating the annualized return of an investment.

What S The Worst 10 Year Return From A 50 50 Stock Bond Portfolio Finances Money 10 Years Lost Money

Rolling Return Systematic Investment Plan Take Money Investing

How To Annualized Returns In Excel Excel Return Investing

Check If Your Investment Portfolio Beats The Average Return Investing Investment Portfolio S P 500 Index

20 Year Returns By Sector Investors Economics Asset

Annualized Returns By Asset Class From 1999 To 2018 Financial Samurai Investing Investing Money Ways To Get Rich

Types Of Activity Turnover Ratios Financial Ratio Accounting Books Financial Analysis

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

However You Re Defining Risk In This Scary Stock Market You Re Probably Wrong Marketwatch Stock Market Personal Financial Planning Standard Deviation

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing

How To Do Better When Investing For Trusts And Uhnw Individuals Investing Individuality Trust

10 Year Cagr S P500 Projection Investing Stock Market Personal Finance

Pattern I Pattern Design Dribbble

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

25 Years Annualized Returns By Asset Class Investment Banking Investing Banking

Have Stocks Really Bottomed 3 Things Investors Need To Know Seeking Alpha Dividend Stock Market Investing Positivity

Dispersion Of Returns Across Asset Classes Old Quotes Graphing Retirement Benefits